The first sign of change on Azalea Drive wasn’t the new roofline or the fresh paint. It was a neighbor, pausing at the curb as workers hauled out the last of the old carpet: “I’m so happy you all did this,” they said quietly to an on-site project manager. “This house was vacant for years. It feels like I’m getting my neighborhood back.”

In Trotwood’s Townview neighborhood, that feeling is spreading. What used to be block dotted with boarded-up ranch-style homes now hums with the small, hopeful sounds of progress—air compressors, tape measures snapping back, a front-porch light that finally works again. For the team at the Trotwood Community Improvement Corporation (TCIC), this isn’t just another construction project. It’s giving a neighborhood a second chance and proving what’s possible when local organizations and community-minded financial partners, like Civista Bank, work together toward the same vision.

The Start of the Journey

Like many Ohio communities, Trotwood took a one-two hit during and after the Great Recession. Jobs tied to the Salem Mall corridor shrank as big-box retail struggled. At the same time, waves of mortgage and tax foreclosures left entire streets with empty houses. “At one point, we had upwards of 1,000 vacant properties,” says Derek Williams, Vice President at TCIC.

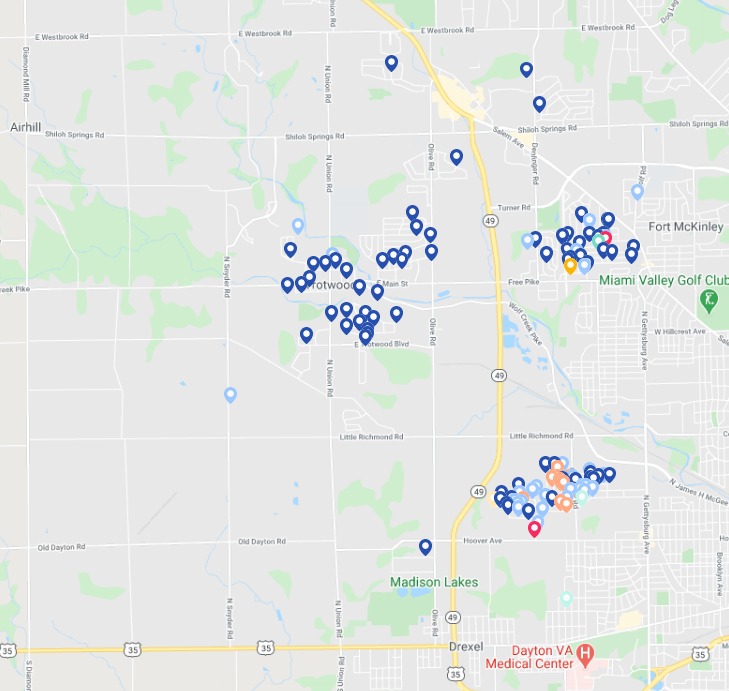

A map showcasing the properties marked for the Trotwood Housing Rehabilitation Program.

The city responded by creating TCIC, a nonprofit re-established in 2012 that has implemented redevelopment programs that gives vacant, tax-foreclosed homes a new future. Early on, that meant working with responsible developers to revitalize properties as rentals. As the market improved, TCIC pivoted to something more permanent: helping families buy those homes and put down roots again. “This phase is really the crescendo,” Williams says. “We’re bringing them back as homes.”

Williams is clear-eyed and purposeful about the work the organization is doing. With a background in mortgage financing and years spent working in community development, he combines technical expertise with a deep personal commitment to Trotwood’s future. After first interning with TCIC in college, he later returned to the organization to help lead its housing initiatives, a full-circle moment that reflects his passion for helping neighborhoods thrive.

“I believe in what this community can be,” he says.

Why Townview & Why Now

Williams lights up when he talks about Townview. The Trotwood neighborhood is a tight-knit and historically Black community, originally built for factory families across the Dayton area. The homes themselves are modest three-bedroom, one-bath rectangles, roughly 800 to 900 square feet, most on slab foundations.

“They’re easy to rehab and, more importantly, easy to maintain,” Williams says. “For first-time buyers or people downsizing to age in place, these homes help them avoid the surprises older properties can bring. Our goal is that once the owner moves in, they won’t have to fix or replace anything major in the house for 10 years.”

In pursuit of that goal, TCIC is adding modern insulation, upgrading electrical and plumbing systems, and relocating utilities into the attic, so future maintenance is simple and affordable. The result is a “new-old” home at a $120,000 to $130,000 price that works for the “missing middle:” families earning too much to qualify for programs like Habitat for Humanity but unable to compete in a $250,000 to $350,000 starter-home market.

So far, TCIC has already sold two homes using its own funds: one to a first-time buyer and one to a couple downsizing to be near their grandkids. Both families, new to Trotwood, were warmly welcomed by neighbors and quickly became part of the community. “They’ve really set the standard for pride of place,” Williams says. “Wait until you see the yards. They’ve made those homes beautiful.”

The first house completed in the TCIC rehabilitation program.

To accelerate their progress and work on more homes at once, TCIC needed a banking partner that understood the realities of neighborhood rehab—multiple homes under construction at the same time, contractors who need payments as work progresses, and cash flow that naturally ebbs and flows throughout the project.

A Financing Model That Fits the Work

Enter Civista Bank.

“When we first met, it felt like an interview on both sides,” says Mark Whitt, a Commercial Banker at Civista. “They wanted a partner who understood the community. Being an Ohio-based bank that’s committed to community development mattered.”

Civista structured a multiple-advance line of credit. The approach works a lot like a construction loan you draw from as work progresses, so TCIC has efficient access to the capital it needs for projects but only pays interest on what it actually uses.

“For a rehab program across several homes, this structure is what makes cash flow work,” Whitt explains. Known for his deep experience in community development and his approachable, solutions-focused style, Whitt quickly became a trusted partner to TCIC; someone who could translate complex financing into practical steps forward. “Some lenders proposed fully funded loans with principal and interest due from day one. That would have meant paying interest on money TCIC hadn’t even spent yet, which doesn’t make sense for a phased project like this.”

Speed and access mattered, too. “On a project like this, I might not usually get direct access to a senior decision-maker at the bank,” Williams says. “With Mark, we had someone who could move quickly and give our board confidence. They met us where we were. We weren’t just another piece of paper on a desk.”

What began as a plan to rehab six houses quickly expanded to twelve as TCIC, Civista, and the City of Trotwood began to see the program’s demand and potential. With permits approved, environmental cleanup underway, and a general contractor in place, construction on the next four homes will happen concurrently. Each will take about four to five months to complete before hitting the market.

The team’s strategy is deliberate: start at the heart of Townview, on Azalea Drive, and work outward. By selling the first homes in the center, TCIC can help set fair comparable values (“comps”) that strengthen property values for existing residents. “We’re literally building our own comps,” Williams says. “That way, the rising values benefit the people who already live here.”

Once those homes are ready, Civista’s residential mortgage team will step in to help buyers, many of them first-time homeowners, navigate financing. Eligible buyers can pair conventional mortgages with down-payment assistance from the Ohio Housing Finance Agency (OHFA) and other programs designed for specific communities. “We love that families who’ve been waiting for something attainable can complete the journey with a trusted local lender,” Whitt says.

The Three-Pronged Strategy for Renewal

Housing may the most visible signal of progress, but TCIC's vision reaches beyond the front porch. The organization and the City of Trotwood are rebuilding on three fronts:

- Homeownership in Townview: The first phase of rehabs—affordable, low-maintenance homes for first-time buyers and downsizers—will be followed by new construction on roughly 50 additional lots to complete the neighborhood.

- Jobs in Industrial Park: Through land control and smart incentives, TCIC has helped attract two major employers—Beontag and Westrafo—that are expected to bring about 600 well-paying jobs to Trotwood over the next two years.

Westrafo’s opened its new production site in Trotwood on October 9th, 2025.

- Reimagining a Retail Icon: The former Sears building, once part of the old Salem Mall, has secured a $2 million congressional earmark and up to $7 million in historic tax credits. The site is being reimagined as a mixed-use destination that restores energy and pride to one of the city's most visible corridors.

The redevelopment of the old Sears building in Trotwood is slated for a future phase of TCIC’s renewal project.

"We've done it all from the real estate side," Williams says. "Owning the land, selling it, structuring the incentives—it’s powerful when a community can take its future into its own hands.”

Why Community Banking Still Matters

For Civista Bank, projects like this embody what community banking is meant to do: move quickly, think creatively, and invest in local progress.

“This was really about problem-solving and responsiveness,” says Whitt, adding that Civista’s approach honors both.

Williams agrees. “It takes an Ohioan to understand an Ohioan,” he says. “Civista knows what towns like Sandusky and Trotwood have gone through. Their team took an interest in our success, not just the paperwork.”

Inside Civista, that mindset is intentional. “Every week, we look at credits like these and ask, ‘How do we make this work responsibly?’” Whitt adds. “When a project helps a community recover or grow, we find a way.”

This partnership with Trotwood is just one example of Civista’s long-standing commitment to community development. Across the regions it serves, Civista works with municipalities, nonprofits, and local leaders to strengthen neighborhoods, expand access to housing, and support economic growth. For Civista, these initiatives aren’t side projects, they reflect a core belief that a bank’s success is measured by the impact in the communities they invest in and serve.

What Success Looks Like

Ask Williams what success will look like in a few years, and he doesn’t start with numbers. “You see people reinvesting in their homes because they trust the market again,” he says. “You see younger families coming back. You see grandparents aging in place because the house fits their life. Those are the wins.”

For Whitt, its families getting keys to homes that once sat vacant and a community rediscovering its identity. “That’s when you know progress has taken hold,” he says.

The change won’t just be measured in numbers. It will be seen and felt. Flowers blooming on properties where windows were once boarded, new homes filling the gaps between old ones, and steady traffic returning as new jobs take root, and even small moments: like a neighbor pausing at the curb, watching a house turn back into a home.

Building the Future, Together

Rebuilding Trotwood is about restoring confidence, connection, and pride of place. Each new homeowner, each revitalized block, and each local job signals a community moving forward together.

At Civista Bank, we’re proud to stand beside the people and projects shaping stronger Ohio communities. If you’re ready to take the next step, grow your business, invest in your neighborhood, or purchase your first home, our team is here to help make it happen.

Skip Navigation

Skip Navigation

.jpeg)