“Compound Interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t pays it” –Albert Einstein

Disclaimer: The following content is not financial advice and is for informational purposes only.

Key Takeaways:

- Compound interest involves earning interest on both the initial deposit and the interest accumulated over time.

- Common accounts utilizing compound interest include CDs, IRAs, savings accounts, and credit cards.

- Avoid compounding debt by paying off debts quickly.

- Maximize your account growth by saving and investing early, leveraging the compounding effect.

- Share this knowledge to empower financial achievement in others.

What is Compound Interest?

Compound interest is a very important concept to understand when it comes to your finances. It can be a positive tool for growing your savings and investments, or a difficult hurdle to overcome when paying off compounding debt.

So, what is compound interest? Simply put, it is the interest you earn on your interest.

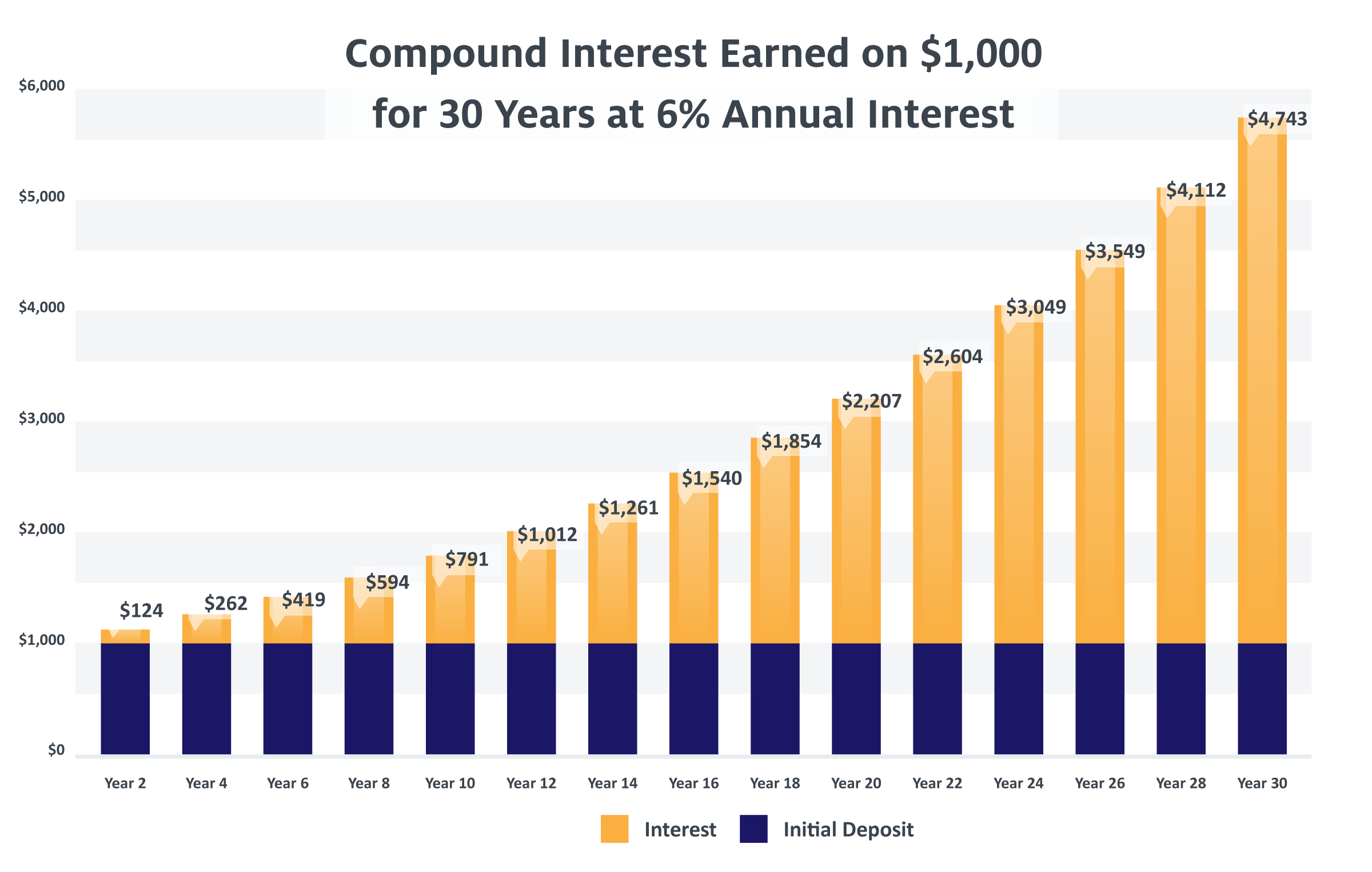

For example, if you deposit $1,000 into a savings account that earns 6% in annual interest, you will earn $60 in the first year. In the second year, you will earn 6% on $1,060 (your initial deposit + interest earned). In the graph below, you can see how powerful compound interest can be over time — allowing the initial $1,000 deposit to earn over $4,500 in interest over a 30-year period.

There are several types of accounts that commonly utilize compound interest including:

- Certificates of Deposit (CDs),

- Individual Retirement Accounts (IRAs),

- Savings Accounts,

- Savings Bonds,

- 401(k)s, and

- Credit Cards.

Tips for Making Compound Interest Work for You

Avoid Compounding Debt

Compounding debt, like credit card debt, can be difficult to pay off. Make sure you pay off your debts quickly and, if possible, make more than the minimum payment to avoid the negative effects of compound interest. To learn more about credit card payments and the importance of making more than the minimum payment, visit the Civista Learning Vault.

Some loan types may offer an opportunity to skip a payment or a deferral period. An example that many consumers may be familiar with are unsubsidized student loans. During the loan’s deferral period, no payments are due, but the loan still earns interest. In these situations, unpaid interest is often capitalized, or added to the loan’s principal amount after the deferral period is over. Make sure you are aware of your loan’s terms and at least make interest payments during the deferral period to avoid accruing interest on a larger loan balance.

Save & Invest Early

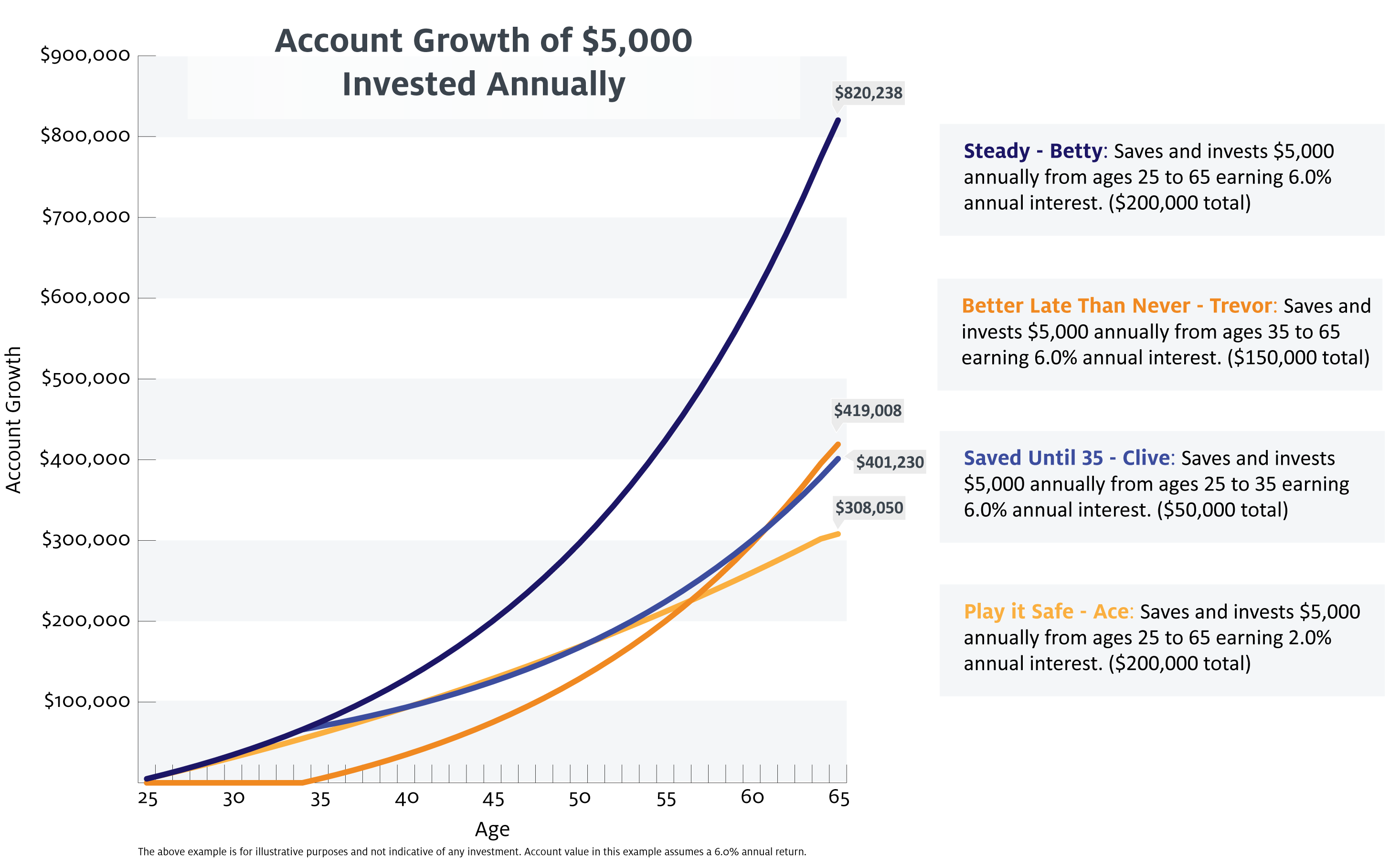

You can also take advantage of compound interest by saving and investing early. Below is an example of how when you decide to start saving can make a difference.

In this example, Betty, who started saving early and consistently, was able to grow her account balance substantially more than the others. More importantly, the example illustrates how time plays a major role in building account growth. Clive only saved $50,000 between the ages of 25 and 35, while Trevor, who started ten years later, saved a total of $150,000 between the ages of 35 to 65. In the end, because Clive started sooner and was able to use compound interest to his advantage, his ending balance was very close to Trever’s while having saved $100,000 less.

Whether you’re saving, investing or borrowing, understanding compound interest can help you make more informed financial decisions and benefit your financial wellness.

For more financial tips visit Civista’s Learning Vault.

Skip Navigation

Skip Navigation