Your Civista Digital Banking gives you the advantage of more insight and control over your money with the Personal Financial Management tool (PFM). See your total financial picture at a glance — even accounts at other financial institutions. Manage your money, review spending trends, establish personalized budgets and more from any device.

How Does the Civista Personal Financial Management Tool Work?

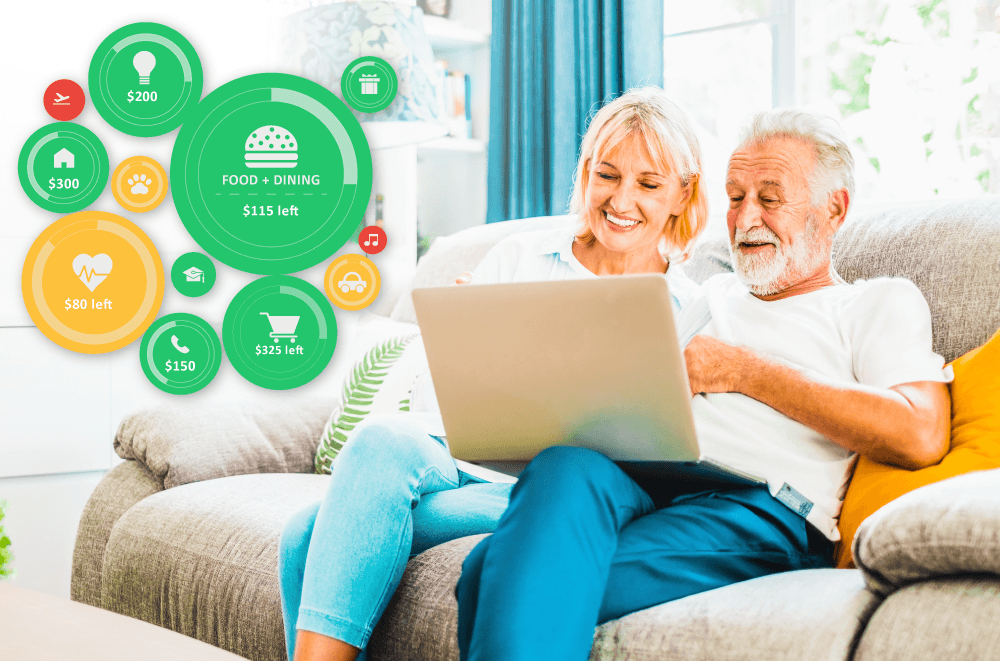

With the Civista PFM tool, you’ll have the ability to analyze your finances across multiple financial institutions with the use of widgets. Widgets are interactive and visually display your data in a way that’s easy to understand – giving you meaningful insight and helping to inform your financial decisions. These widgets include:

Spending – Enables you to see a visual representation of how you are spending your money over a period of time.

Budget – Helps you set budgets for each spending category and track progress towards those categories each month.

Trends – Builds even further on your budgeting categories to help track spending over time as compared to income.

Net Worth – Allows you to see the total value of all Civista Bank-held and linked accounts to view your net worth over time.

Debts – Allows you to see all of your loans in one place and to calculate how making additional payments, or paying off your debt completely, can impact your debt over time.

Benefits of Civista’s Personal Financial Management Tool

- Simplify your life – Eliminate the need to manually track your expenses. Your transactions will be automatically categorized to help you track your spending and find trends and opportunities for savings.

- Make Informed Financial Decisions – You’ll receive real-time, aggregate information about your finances. This actionable data will keep you better informed about your entire financial standing and empower you to make informed financial decisions.

- Achieve Your Goals – This tool will help you along your financial journey. Set obtainable goals for your budget and strategies for paying off your debts with the easy to use widgets.

- Control Your Accounts – Easily review all of your account information from a single, secure login. Review transaction data and stay informed about all of your money matters*.

- View Your Complete Financial Picture – Unlike other financial management apps, your Civista Personal Financial Management tool allows you to add a variety of accounts and assets to your dashboard. Add assets like your home and car for a better understanding of your net-worth and complete financial picture.

Frequently Asked Questions

Click on 'Link Account' under the 'Spending' section on the right to connect your other non-Civista accounts. A list of popular financial institutions will appear. You can click on any of the names showing or type the name of your bank or credit union into the search bar.

You will then need to provide the credentials for the non-Civista account and click continue. If your other financial institution requires multi-factor authentication, you will be prompted to supply more information to complete the login.

You can organize and tag your accounts to customize your dashboard.

You can update your login credentials by going to the desired linked account, swipe left or click the two vertical bars, then select 'Update Login'.

Enter your updated credentials, then click 'Continue'.

Yes, the PFM tool allows you to manually link accounts and assets. This can be especially helpful for viewing your net-worth by including assets like your house or car.

To add an account, click on 'Link Account' under the 'Spending' section on the right. At the bottom there is an ‘Add a Manual Account’ option. Provide the account name, type and balance to add to your financial picture. Note – some account types will trigger additional fields. For example, choosing loan under account type will generate fields for financial institution and APR.

No, your linked accounts are view-only, however you are able to see their account balances and transactions. You will not be able to initiate any new transactions on these accounts from the PFM tool. You can however, link savings and checking accounts at other financial institutions via the 'Manage External Accounts' tool for external account transfers, located under the 'Transfer' menu.

Your transactions are automatically categorized to help you track your spending; however, you can re-categorize transactions for a more accurate view of your accounts.

Within the Account Details page, you can click on a transaction to modify its category, add a sub-category or change its online description. Even split a transaction into multiple categories for more control over your budget.

Note that changing the description only changes the description within your digital banking and will not be reflected on statements.

My transactions are not categorized, can I add a category or description?

If your transaction is uncategorized, you can add a description and category for an accurate view of your accounts.

Skip Navigation

Skip Navigation