In the world of digital banking, one trend continues to stand out: hyper-personalization. Customers should expect their digital banking experience to be styled with their individual needs and preferences. Let's explore Civista’s various tools that are empowering customers to customize their banking.

Tailored Digital Banking Experience

Customized Financial View

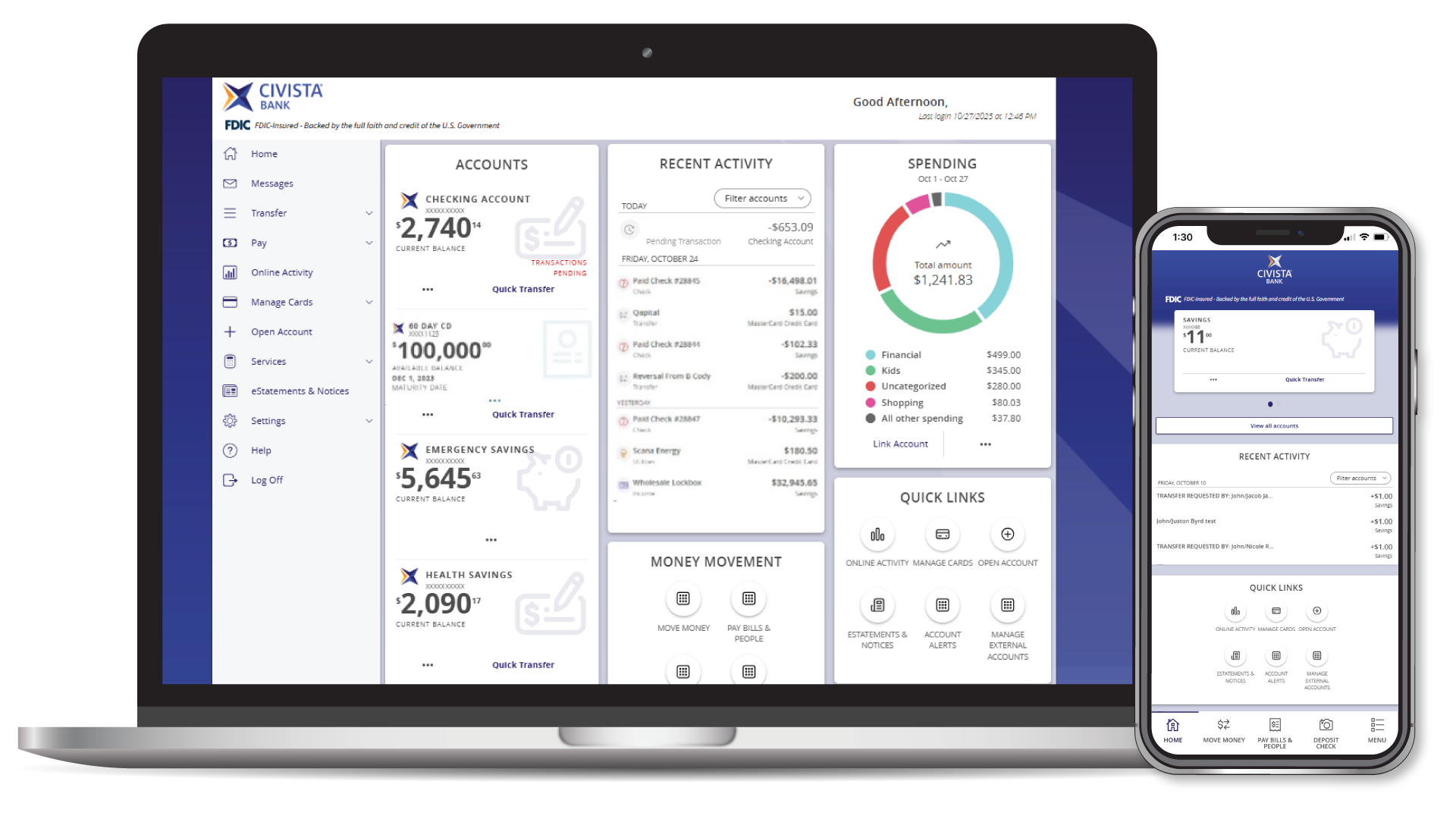

Civista's Digital Banking enhances your experience with a customizable dashboard, designed for personal and efficient banking. It serves as your command center, showcasing editable tiles for each account with clear, customizable names and essential details for streamlined and quick access.

Personalize with Nicknames

Adding nicknames to your accounts is a simple yet effective way to personalize your banking experience. Label your savings account as ‘Emergency Savings’ or ‘Vacation Fund’ for a clearer understanding. Remember, these nicknames are only visible to you on your personalized dashboard and won’t be seen by joint account holders or your Civista Banker.

Streamline Your View by Hiding Accounts

If you want a cleaner dashboard or need to focus on specific accounts, the option to hide certain accounts is available. This is particularly useful if you have joint accounts or wish to avoid the temptation of accessing certain funds, like your emergency savings.

To customize your dashboard, go to the ‘Settings’ menu and ‘Account Preferences’ to view your options.

A Complete Financial Picture

Civista’s ‘Financial Tools’ and account aggregation allows you to link and view accounts from different financial institutions alongside your Civista accounts. This includes checking and savings accounts, investments, loans, and credit cards, regardless of where they are held*. By having all your financial information in one location, you gain a holistic view of your finances.

With all your accounts linked, tracking your overall financial status becomes straightforward. You can monitor balances, view transactions across different accounts, and track your spending habits all from a single dashboard. This consolidated view eliminates the need to log into multiple banking platforms, saving you time and simplifying your financial management.

Categorize Payments for Accurate Spending Insights

Civista Digital Banking streamlines your finances by automatically categorizing transactions from your Civista accounts and linked accounts from other institutions.

This feature helps you accurately monitor your spending patterns and keep your budgets on track. While automatic categorization is highly efficient, you also have the flexibility to modify these categories as needed. This personal touch ensures that your transaction data aligns perfectly with your actual spending.

Modifying Descriptions

You have the option to edit transaction descriptions, making them more meaningful or easier to recognize. This customization is particularly useful for identifying specific expenses or income sources at a glance.

Splitting Transactions

For transactions that cover multiple expenses, the 'Split Transaction' feature allows you to divide a single transaction across different categories. This is especially useful for purchases that encompass various budget areas, ensuring that each portion of the transaction is accurately reflected in your budgeting.

Creating Subcategories

For a more detailed financial breakdown, you can create or edit subcategories. This granularity helps in tracking specific types of spending or income more precisely.

While you can change transaction descriptions, it's important to note that these changes will only reflect within your digital banking and not in paper or eStatements.

Learn more about categorizing your transactions.

Personalized Budgeting and Spending Tools

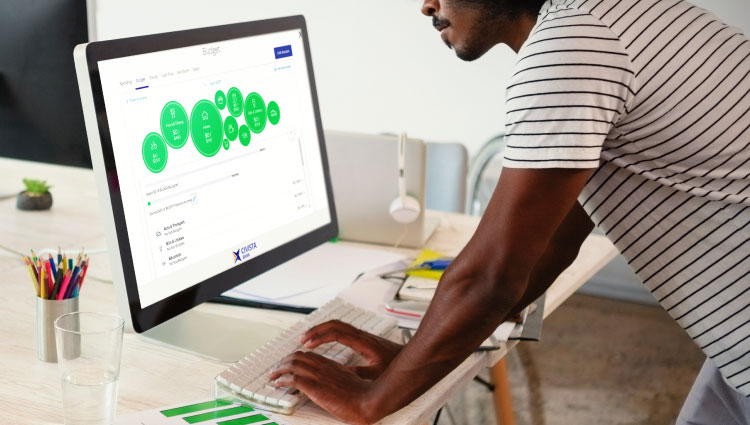

Your Civista Digital Banking also offers budgeting and spending tools to help you take control of your finances. Dive into a detailed review of your categorized spending to uncover valuable insights into your expenses. This analysis highlights potential saving opportunities, offering a clearer understanding of where your money is going. By tracking your expenditures across various categories, you gain a comprehensive view of your spending habits.

The budgeting tool allows you to set specific budgets for different spending categories, enabling you to allocate funds more strategically. Whether it’s groceries, entertainment, utilities, or any other category, you can tailor your budget to match your lifestyle and financial goals.

Keep a close eye on your spending throughout the month in each category. This ongoing tracking helps you stay within your set budgets and make adjustments as needed. It's an effective way to ensure that your spending aligns with your financial goals.

As you navigate through the month, visual representations in the tool show you how close you are to reaching your spending limits. These visuals serve as a quick and easy reference, enabling you to gauge your financial status immediately and adjust your spending behavior accordingly.

Automation

From scheduling regular transfers into savings accounts to automating loan payments, this functionality aligns perfectly with our customers’ busy lifestyles — ensuring your financial plans stay on track without constant oversight.

Automatically Save

There are two convenient methods to automate your savings. First, you may opt for a portion of your paycheck to be directly deposited into your savings by your employer. Alternatively, your Civista Digital Banking offers an easy solution with its 'Move Money' menu, where you can establish recurring transfers to your savings account.

By setting up regular deposits, you cultivate a habit of consistent saving. Choose an amount that fits your budget, whether it's a modest weekly transfer or a more significant monthly sum. The flexibility of this feature allows you to tailor the frequency and amount of deposits to align with your financial goals and income cycle. You can adjust these settings at any time, making it easier to increase your savings as your financial situation improves or during times when you have additional disposable income.

You're not limited to your Civista accounts; you can also transfer funds from an external financial institution as well. Here's a quick guide on how to set up an external account.

Setting Your Loan Payment on Autopilot

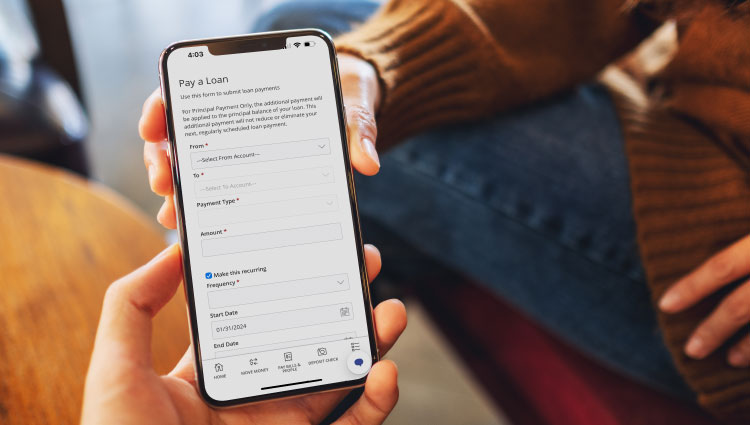

Managing loan payments can be a daunting task, but with Civista's ‘Pay a Loan' feature, you can streamline this process significantly. This convenient tool allows you to automate your loan payments, ensuring they are timely and consistent, without the need for manual transfer each month.

Whether your funding account is with Civista or another financial institution, you can easily set up your loan payments to be automatically transferred. This flexibility is a significant advantage, allowing you to manage your finances from a single platform, regardless of where your funds are held. You choose the amount and the frequency of your payments. Whether you prefer to make monthly, bi-weekly, or another frequency that suits your budget, you have the control to set it up according to your budget. Automating your payments will save you time and mental energy, giving you the peace of mind that comes with knowing your financial obligations are being met automatically.

By using the 'Pay a Loan' feature specifically, rather than a normal transfer, you ensure that your payments are processed correctly as loan repayments. This distinction is crucial for proper crediting to your loan account and avoiding any confusion that might arise from standard transfers.

Enhanced Security

Civista Digital Banking prioritizes your safety with personalized security features, blending advanced technology with user-friendly options to safeguard your accounts. Beyond biometric and two-factor authentication features, Civista offers alerts to keep you updated and in charge.

Customizable Security and Account Alerts

Keep track of your account activity effortlessly with customizable security and account alerts. Set alerts for significant transactions, login attempts, and changes in account information. Avoid overdraft fees with balance alerts that notify you when your funds fall below a set threshold. Additionally, stay updated on transaction types and check clearances, and even set reminders for upcoming expenses.

With Civista’s suite of customizable tools and features, we invite you to delve into and make the most of your digital banking experience. Embrace the hyper-personalized banking with Civista and transform the way you manage your finances for a future that's as unique as you are.

Skip Navigation

Skip Navigation